Aluminum is a strong, lightweight, recyclable metal that has become a component of innumerable products. As the Aluminum Association states, “The metal is so ubiquitous that many of us don’t even realize how often it touches our lives. In fact, people use more aluminum today than at any point in the 125-year history of the metal’s commercial production. Aluminum is critical to modern mobility and connectivity and without it, many of the conveniences of today’s world would simply not exist.” It is a critical part of many companies’ supply chain.

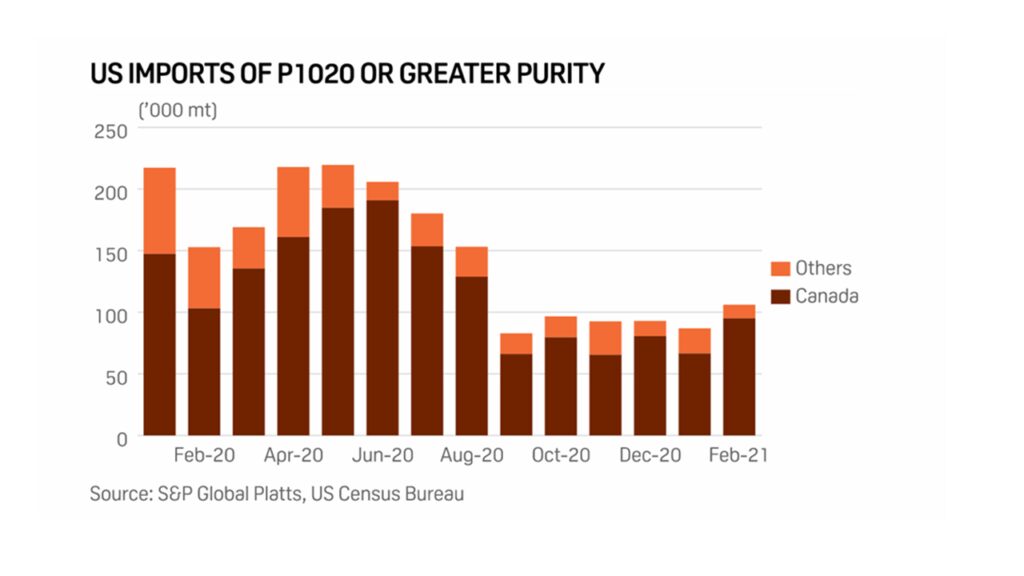

The U.S. Census Bureau reported total primary high purity aluminum P1020 ingot imports fell 30.57% year on year in February. and shipments of the higher purity aluminum fell 85%. The primary aluminum imports of unwrought aluminum were also down 6.66% yr./yr. Canadian imports, which are not subject to U.S. quotas, accounted for 90% of the U.S. imports of P1020. P1020 shipments from New Zealand which usually supplies the West Coast and South were down 100%

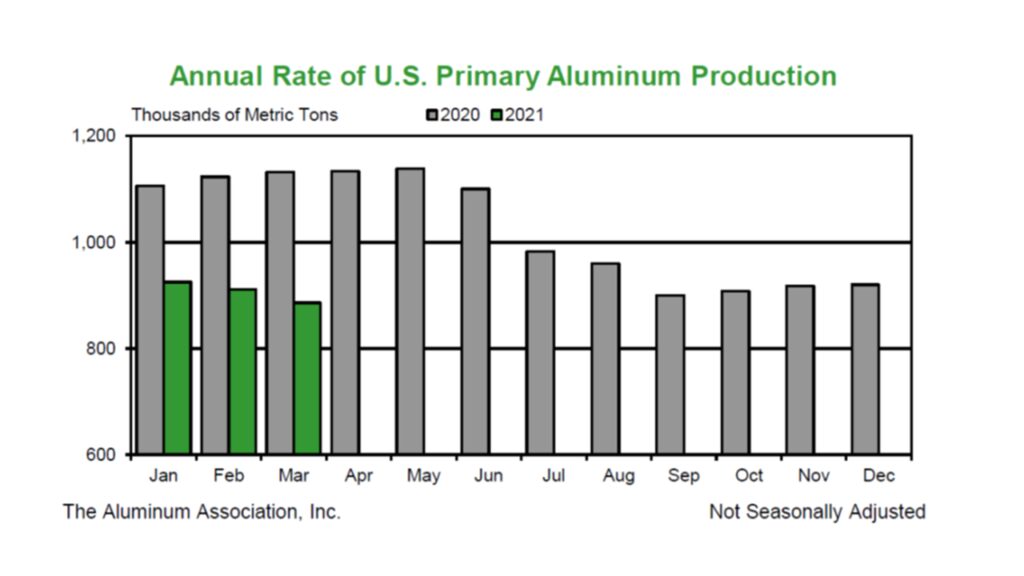

You would expect that with imports being down, U.S. production of Aluminum would grow to fill the gap. U.S. production has also fallen; down 19% versus 2020, and is making the shortage greater.

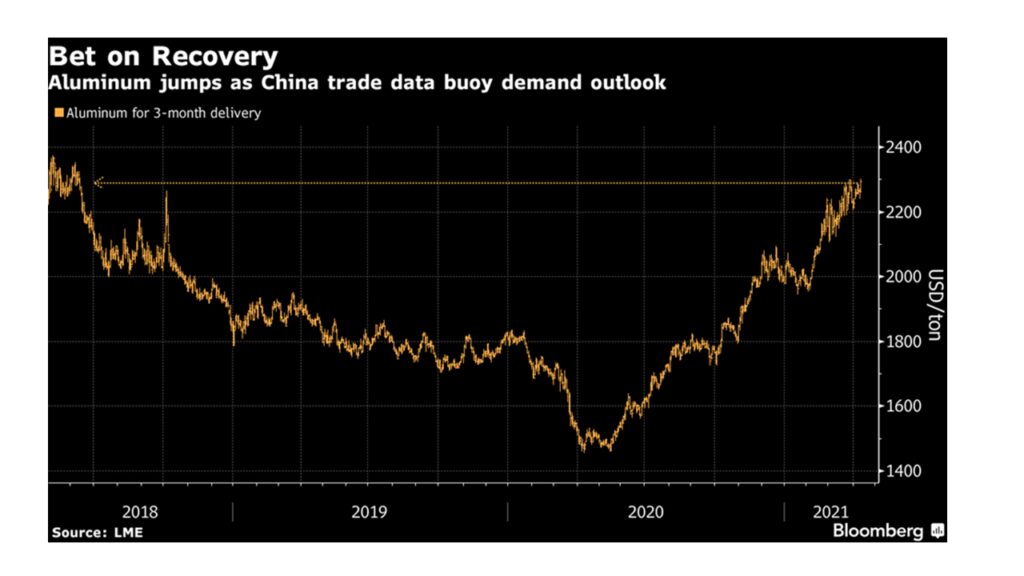

This tightening of the aluminum supply is seeing a corresponding rise in aluminum price. The London Metal Exchange three month delivery for Aluminum rose 1.4%. and prices are at levels not seen since 2018. As the world economy recovers, pressure on these prices will continue to grow.

Source Bloomberg Post “Aluminum Jumps to Highest Since 2018 on Strong China Trade Data”; Yvonne Yue Li, 4/14/2021

Aluminum is used across a broad spectrum of industries including automotive, aerospace, appliances, and electronics. When was the last time one drank a beverage from a tin can? Many of these companies are large corporations that can source the aluminum under large contracts and accounts for most of the supply of aluminum supply available. The remaining supply is consumed by mills that form the aluminum and sell the rolls, sheets and castings to supplier/distributors.

Many suppliers are constrained by quotas from the mills and it is common for suppliers to be out of stock of certain grades and gauges of aluminum with delivery cycles up to 2 months. The prices also increase with each cycle as the material becomes more costly. These delays and costs affect the delivery cycle and cost of products that fabricated and machined parts suppliers produce.

Keddie Enterprises has taken steps to minimize the impact to our customers. We have expanded the number of suppliers, sourcing material out of DFW and Houston areas. We communicate regularly with our suppliers to evaluate material availability and pre-purchase common consumed stock to minimize impacts. We also communicate with our customers on how these issue may impact them and steps they can do to lessen the impact. Is your fabricated and machined parts supplier doing this for you to protect your supply chain? If not, consider a change to Keddie Enterprises and contact us at sales@Keddieco.com